This is What the New Normal Looks Like for the Labor Market

May 14, 2025

The labor market feels and looks quite different today than the frenzied beast we witnessed in 2021 and 2022. Its pace of expansion is slower and more sustainable, the imbalance between labor supply and demand has moderated significantly, and wage growth has decelerated to levels that are closer to historic norms and more manageable for firms. The latter factor, a particularly painful development that companies of all sizes struggled with during the fervor of the post-pandemic job market boom, is welcome news for NAFA members.

Today, the proverbial pendulum has swung from squarely in the candidate’s corner to a more balanced position, where neither job seekers nor employers have a disproportionate amount of power and sway. The Great Resignation is firmly in our rear-view mirror, and while layoffs are still low by historic standards, most people today feel grateful to be gainfully employed. In other words, welcome to the new normal.

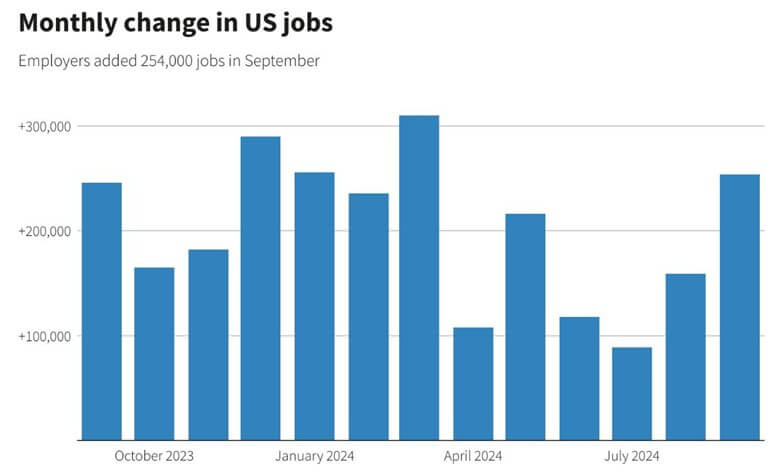

This normalization has been occurring steadily for the better part of the last two years. Compared with the average monthly gain of 399,000 seen in 2022, job growth averaged 225,000 per month in 2023. So far in 2024, the average has declined further to just over 200,000 jobs per month. As the pace of job growth decelerated, the unemployment rate gradually crept up from the 3.4% last seen in early 2023, while average annual wage growth has meaningfully moderated, alleviating cost pressures for many employers. These developments show that, while substantially slower than in the previous two years, the labor market remains healthy, at least for now.

[Insert Image 1]

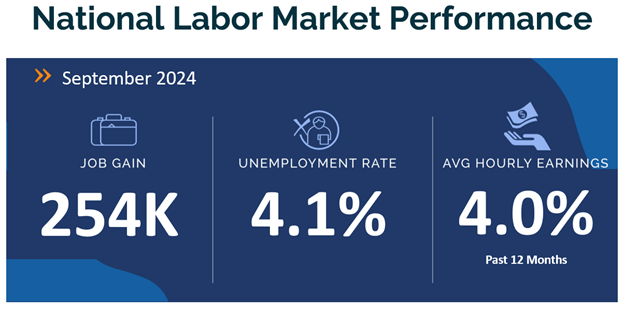

However, the latest data also provides signs of a tangible slowdown. Although this month’s jobs report from the Bureau of Labor Statistics, which showed that nonfarm employment rose by 254,000 jobs in September, surpassed expectations, it’s evident that the US economy is adding jobs at a slower pace in the last six months than it did in the previous six months. The unemployment rate stands at 4.1%, about half a percent higher than last year, while wage growth has cooled to 4.0% year-over-year for the past 12 months. This data reflects what many people have felt for quite some time, that the labor market and the overall economy may be running cooler than the headline macro numbers suggest.

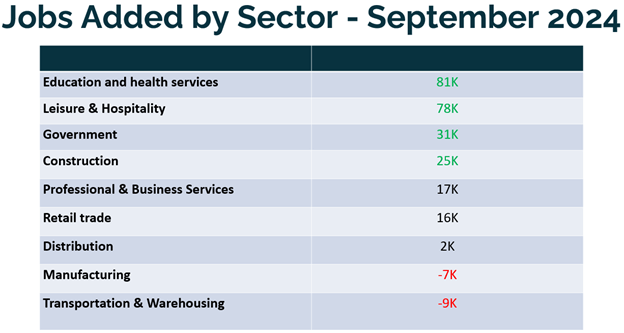

To get a real sense of the labor market’s vitality today – in late 2024 – a review of some of the latest report’s details is warranted. Leisure & Hospitality (+78,000), Healthcare (+72,000), Government (+31,000), and Construction (+25,000) accounted for more than 80% of all new job gains in September. In contrast, the Manufacturing industry, which includes many NAFA member companies, lost 7,000 jobs last month.

The concentration of job gains in a few key industries is not a new development. In 2023, more than half of all new jobs created were in the healthcare, leisure & hospitality, and government sectors. A much smaller percentage of the jobs generated last year were in the manufacturing and distribution space. Today, manufacturers and distributors alike are cutting back headcount expansion plans in the face of increasing macroeconomic headwinds, while continuing to backfill key roles that become open due to attrition.

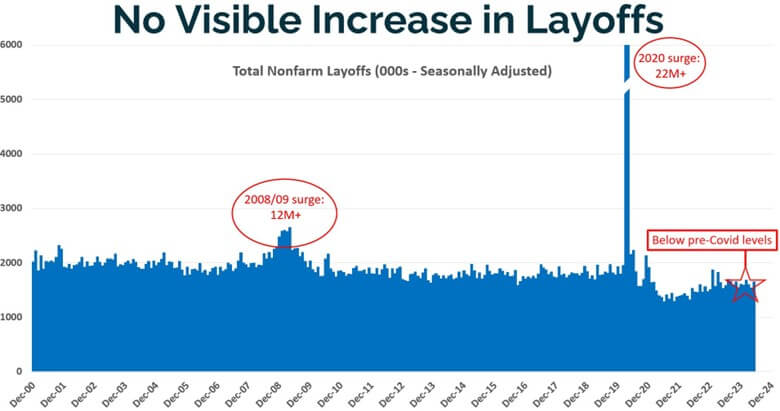

Although the unemployment rate is elevated compared to last year, it has ticked higher largely because hiring volumes aren't enough to keep up with new entrants to the labor force in recent months. The good news is that unemployment has not risen because of a sharp increase in layoffs. This dynamic partly alleviates concerns about triggering the Sahm rule, which is an economic theory that states a recession is probable if the three-month average of the unemployment rate exceeds the lowest unemployment rate over the past 12 months by 0.5 percentage points or more.

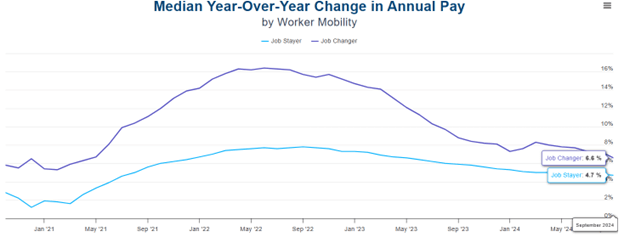

The deceleration in wage growth has been a welcome development for organizations of all sizes. According to data from ADP Research Institute, in mid-2022 job stayers were seeing changes in annual pay of nearly 8%, while those willing to change jobs were realizing compensation increases of 16%, on average. This created a dynamic where many companies had no choice but to pass on higher labor costs to their customers in the form of higher prices, contributing to the rapid rise in inflation we saw during that period.

The latest data from ADP shows that today, on average, job stayers are seeing annual pay increases of 4.7%, while job changers are still obtaining a premium at 6.6%, although that gap has closed significantly. This alleviates some of the pressure companies are feeling from rising payroll expenditures and makes it more manageable to remain profitable in the face of increasing costs in other parts of the business.

Hiring managers and recruiters report that compensation is still a challenge in the effort to hire (with many businesses still backfilling and adding new positions) and retain talent. In 2021 and 2022, the challenge was keeping up with rising pay demands during a period when many workers were quitting their jobs for higher pay elsewhere. The challenge has evolved to include compensation structures, job hierarchies, pay band creation, and compliance with pay transparency, all of which are pivotal to competitiveness given the changes in the labor market over the last few years, and the emergence of the new normal.

Author: Alex Chausovsky is a highly experienced market researcher and analyst with more than twenty years of expertise across subjects, including economics, industrial manufacturing, automation, talent and workforce issues, and advanced technology trends. For the last two decades, he has consulted and advised companies throughout North and South America, Europe, and Asia, and his insights and analysis have been featured on NPR, the BBC, and in the Wall Street Journal.